Sliding Scale Fee

Practices must develop a pricing policy addressing establishment of usual and customary charges, applying income-based discounts, non-sliding fee scale services, third party billing/reconciliation, Medicaid (physician administered drugs, fee for service drugs (340b), managed care, Medicaid as secondary payer). This information may be included in the agency’s Fee and Eligibility or other financial policies. Art of Therapy Center is no different. Please continue reading to see how we have established eligibility for sliding scale and other ways to pay for your services.

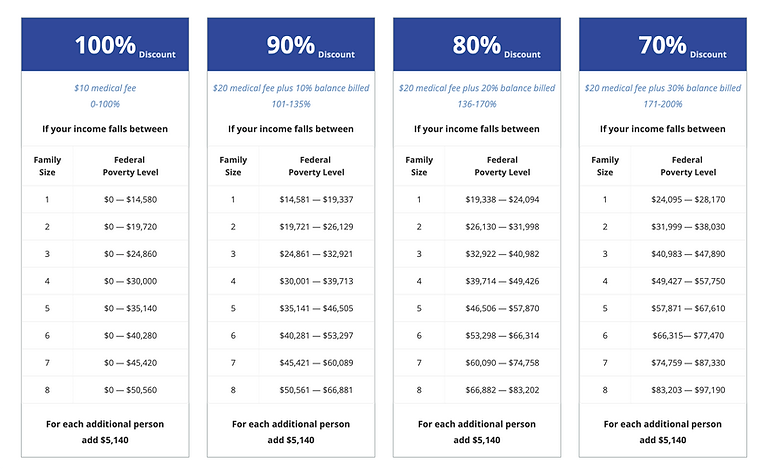

Sliding Scale Fee Schedule

Determining Family Size

A family is defined as a group of related or non-related individuals who are living together as one economic unit. Individuals are considered members of a single family or economic unit when their production of income and consumption of goods are related. An economic unit must have its own source of income. Also, groups of individuals living in the same house with other individuals may be considered a separate economic unit if each group support only their unit. A pregnant woman is counted as two (including the unborn child) in determining family size

Determining Family Size

1. A foster child assigned by DSS with income considered to be paid to the foster parent for support of the child. (Family of 1)

2. A student maintaining a separate residence and receiving most of her/his support from her/his parents or guardians. (Self-supporting students maintaining a separate residence would be a separate economic unit.). (Dependent of the family)

3. An individual in an institution. (Separate Economic unit)

4. A client who requests “confidential services”, regardless of age. (Family of 1)

5. If a Family Planning client presents for a service and is considered to be a minor, interview questions may include the following:

1) Ask the client if their parents are aware of their visit?

2) Ask if “both” parents are aware of their visit, since sometimes the mother may be present with the client, however, the father may not be aware of the visit.

3) Ask if you can send a bill to the home, to both parents.

If the client states both parents are aware and it is not a confidential visit, you should treat as such and use all family members in the economic unit.

Determining Gross Income

Gross income is the total of all cash income before deductions for income taxes, employee’s social security taxes, insurance premiums, bonds, etc. For self-employed applicants (both farm and non-farm) this means net income after business expenses.

-

Alimony

-

Bank Statement

-

Cash (any cash earnings, contributions received)

-

Check Stub (includes regular wages, overtime, etc.)

-

Child Support (cannot consider as income for Family Planning)

-

Client Statement

-

Disability

-

Dividends

-

Employment Security Commission

-

Income Tax Return (annual, not quarterly)

-

Letter of Verification from Employer

-

Military Earnings Statement

-

NC Unemployment

-

Pensions

-

Social Security

-

SSI

-

Tips

Exceptions

-

Payments to volunteers under Title I (VISTA) and Title II (RSVP, foster grandparents, and others) of the Domestic Volunteer Service Act of 1973

-

Payments received under the Job Training Partnership Act

-

Payments under the Low-Income Energy Assistance Act

-

the value of assistance to children or families under the National School Lunch Act, the Child Nutrition Act of 1966 and the Food Stamp Act of 1977

-

Veteran’s Disability payments

No client will be refused services when presenting for care based on lack of income documentation, however each client will be billed at 100% until proof of income and family size is provided to the agency. The client will have ____days (agency may determine time limit) to present this documentation in order to adjust the previous 100% charge to the sliding fee scale. If no documentation is produced in ___ days, then the charge stands at 100% for that visit. This does not apply to non-sliding fee scale services which should be paid in full on the date of service.

Computation of Income

Income will be based on a twelve (12) month period. If the client is working the day they present for a service, income will be calculated weekly, bi -weekly, monthly or annually, depending on the documentation obtained.

If the client is unemployed the day they present for their service, their “employment only” income will be calculated at zero (0), however the client should be required to provide “their mechanism”, in regard to their paying for food, clothing, shelter, utility bills, etc. Refer to “sources of income” counted and apply all sources, as appropriate. “Regular contributions received from other sources outside of the home” is most often considered one of those sources. If the client is receiving unemployment or other “sources” of income, as designated above, all of those sources should be counted.

The client’s income will be determined by the following:

Regular Income Formula:

(Based on 12 month Period)

Use Gross Income or for self-employed income after business expenses.

Weekly = pay x 52

Biweekly = pay x 26

Twice a month = x 24

Unemployment or Irregular Income Formula:

Six months’ formula

(Based on 12 month Period)

-

Unemployed today = last 6 months income + projected unemployment (if applicable) or zero if client wont’ receive unemployment. This will give you income for the client for a 12 month period.

-

If no unemployment compensation – ask how the client is going to support themselves.

-

-

Employed today but unemployed last 6 months – Did the client receive unemployment the last 6 months? In no, record as zero and then project 6 months forward at current income. This will give you income for the client for a 12 month period.

CLIENT AND THIRD-PARTY FEES

-

If a local provider imposes any charges on clients for maternal and child health services, such charges:

-

Will be applied according to a public schedule of charges;

-

Will not be imposed on low-income individuals or their families;

-

Will be adjusted to reflect the income, resources, and family size of the individual receiving the services.

-

-

If client fees are charged, providers must make reasonable efforts to collect from third party payors.

-

Client and third-party fees collected by the local provider for the provision of maternal and child health services must be used, upon approval of the program, to expand, maintain, or enhance these services. No person shall be denied services because of an inability to pay.

Title X Requirements Related to Income Collection for Confidential Clients

Title X requires that any client seeking confidential services be considered a family of one and that only their income would be used in assessing their percent pay on the sliding fee scale.

A copy of the Income and Eligibility Statement be maintained for future reference. The number in the household, annual gross income and percentage of pay should be reflected on the financial documentation. The documentation should be signed and dated by the interviewer and client. Use of electronic signatures is acceptable.

Income is re-assessed annually unless there has been a change in financial status. Following the initial financial eligibility determination, the client will be asked at each visit if there has been a change in their financial status. Income will always be based on the “actual date” of service. If there has been a change or it is time for their annual review the income determination process should take place.

Client fees are assessed according to the rules and regulations of each program and the recommended Program’s Poverty Level Scale (Sliding Fee Scale) will be used to determine fees. All third-party providers will be billed, without discount, where applicable.

Clients presenting with third party health insurance coverage where copayments are required shall be subject to collection of the required copayment at the time of service. For Family Planning (Title X) clients the copay may not exceed the amount they would have paid for services based on sliding fee scale.

Income information reported during the financial eligibility screening for one program can be used through other programs offered in the agency, rather than to re-verify income or rely solely on the client’s self-report.